Comparision between ULIPs and Mutual Funds

Don't fall into the trap of misselling ULIPs as better Investment

Why Mutual Funds Are Better Than ULIPs

When it comes to investing, choosing the right financial product is crucial for achieving your long-term goals. Two popular options are Mutual Funds and Unit Linked Insurance Plans (ULIPs). While both have their own advantages, Mutual Funds often come out on top for several reasons.

1. Simplicity and Focus

Mutual Funds are straightforward investment vehicles that focus solely on wealth creation. They pool money from multiple investors to invest in a diversified portfolio of securities like stocks, bonds, and money market instruments. This simplicity allows investors to focus on their financial goals without the added complexity of insurance components.

2. Flexibility and Variety

Mutual Funds offer a wide range of investment options, catering to different risk appetites and financial goals. Whether you prefer equity funds, debt funds, or balanced funds, there's a Mutual Fund for everyone. Additionally, you can invest in Mutual Funds through Systematic Investment Plans (SIPs) or lump sum payments, providing flexibility in how you allocate your funds.

3. Cost Efficiency

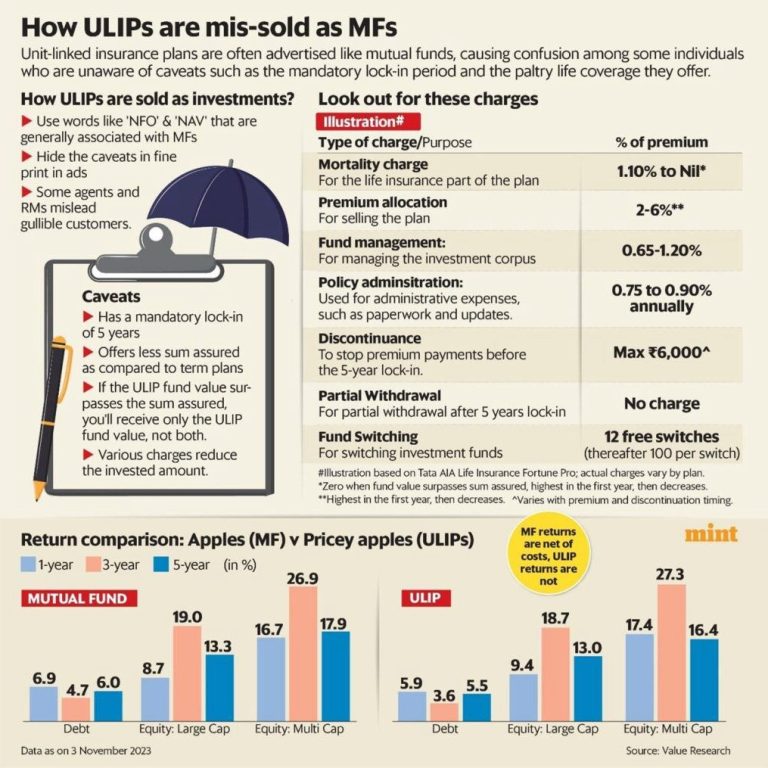

One of the biggest advantages of Mutual Funds is their cost efficiency. Mutual Funds typically have lower fees compared to ULIPs, which include insurance premiums and other charges. This means more of your money is invested in the market, potentially leading to higher returns over time.

4. Transparency and Control

Mutual Funds are managed by professional fund managers who make investment decisions on behalf of investors. However, you still have control over your investments and can choose to switch funds or redeem your units at any time. This transparency and control are often lacking in ULIPs, where the insurance component can complicate matters.

5. Tax Benefits

While both Mutual Funds and ULIPs offer tax benefits, the structure of these benefits can vary. Mutual Funds provide tax benefits under Section 80C of the Income Tax Act for investments up to ₹1.5 lakh per year. However, ULIPs offer tax benefits on premiums paid and maturity proceeds, but the lock-in period can be longer, and the tax benefits may not be as straightforward.

6. Performance and Returns

Historically, Mutual Funds have delivered competitive returns compared to ULIPs. While ULIPs combine insurance and investment, the returns are often lower due to the insurance component. Mutual Funds, on the other hand, focus solely on investment, allowing for potentially higher returns over the long term.

7. No Lock-in Period

Unlike ULIPs, which typically have a lock-in period of 5 years, Mutual Funds do not have a mandatory lock-in period. This means you can access your funds whenever you need them, providing greater liquidity and flexibility.

Conclusion

While ULIPs offer the dual benefit of insurance and investment, Mutual Funds are often a better choice for investors looking for simplicity, cost efficiency, flexibility, and potentially higher returns. By focusing solely on investment, Mutual Funds allow you to tailor your portfolio to your specific financial goals and risk tolerance.

I hope this article helps you understand why Mutual Funds might be a better option for your investment needs. If you have any more questions or need further assistance, feel free to reach us for more detailed personal Financial Plan

Write to contact@fin-zen.org

SEBI Registered MF Advisor (ARN-180148) , Govt Certified Income Tax Practioner , NISM Certified Financial Goal Planner

©Copyright. All rights reserved.

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.